A smattering of new technologies is transforming healthcare.

Copyright: verdict.co.uk – “What is medtech, and where will it go next?”

Medtech startups are going from strength to strength. Investors have upped the funding dosage injected into the industry every year over the past decade.

Medtech startups are going from strength to strength. Investors have upped the funding dosage injected into the industry every year over the past decade.

However, that doesn’t explain what medtech is or why venture capitalists are so eagerly betting on the sector’s future.

But don’t worry, we’ve got you covered.

What is medtech?

“Medtech” stands for medicinal or medical technology. It is shorthand for technologies used within the medical realm.

Now, technically one could argue that things like scalpels, X-rays and stethoscopes would also fall under this category. After all, they were high-tech when they first popped into the scene and they are, undoubtedly, used by doctors around the planet.

However, the term medtech mainly applies to modern technologies with novel applications in healthcare. In other words: the term refers to high-tech solutions like artificial intelligence (AI) systems and robotics being used by doctors, nurses, pharmacologists and other medical practitioners.

Investment in medtech is spiking

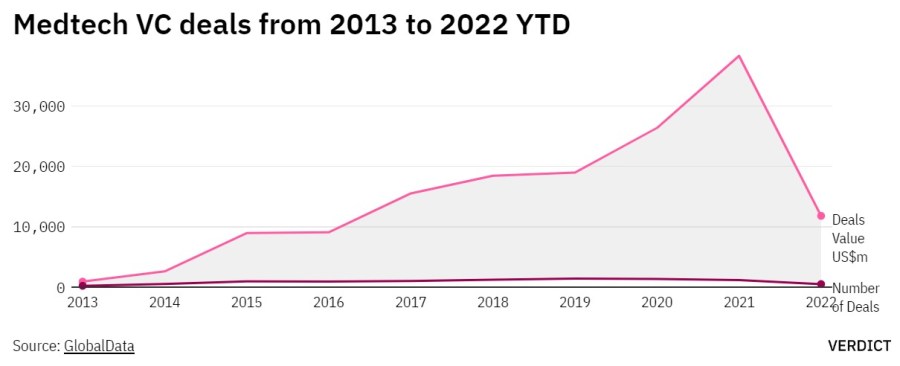

VCs have backed medtech en masse over the past decade. In 2013, investors injected $914m into the global industry across 220 deals, according to data from research firm GlobalData. The number of deals have climbed year on year since. In 2021, VCs bet $38.2bn on the industry across 1,161 deals.

Thank you for reading this post, don't forget to subscribe to our AI NAVIGATOR!

However, there are signs that the flow of investment could be slowing down. As of July 25, only $11.7bn have been injected into the industry across 506 deals. This could be due to industry being caught up in the same macro economic whirlwinds – the war in Ukraine, the end of the pandemic, rising inflation, new regulation to mention a few factors – that now threatens to pop the tech bubble.

Time will tell whether investment will cool down like it seems to do for the tech industry in general.[…]

Read more: www.verdict.co.uk

A smattering of new technologies is transforming healthcare.

Copyright: verdict.co.uk – “What is medtech, and where will it go next?”

However, that doesn’t explain what medtech is or why venture capitalists are so eagerly betting on the sector’s future.

But don’t worry, we’ve got you covered.

What is medtech?

“Medtech” stands for medicinal or medical technology. It is shorthand for technologies used within the medical realm.

Now, technically one could argue that things like scalpels, X-rays and stethoscopes would also fall under this category. After all, they were high-tech when they first popped into the scene and they are, undoubtedly, used by doctors around the planet.

However, the term medtech mainly applies to modern technologies with novel applications in healthcare. In other words: the term refers to high-tech solutions like artificial intelligence (AI) systems and robotics being used by doctors, nurses, pharmacologists and other medical practitioners.

Investment in medtech is spiking

VCs have backed medtech en masse over the past decade. In 2013, investors injected $914m into the global industry across 220 deals, according to data from research firm GlobalData. The number of deals have climbed year on year since. In 2021, VCs bet $38.2bn on the industry across 1,161 deals.

Thank you for reading this post, don't forget to subscribe to our AI NAVIGATOR!

However, there are signs that the flow of investment could be slowing down. As of July 25, only $11.7bn have been injected into the industry across 506 deals. This could be due to industry being caught up in the same macro economic whirlwinds – the war in Ukraine, the end of the pandemic, rising inflation, new regulation to mention a few factors – that now threatens to pop the tech bubble.

Time will tell whether investment will cool down like it seems to do for the tech industry in general.[…]

Read more: www.verdict.co.uk

Share this: