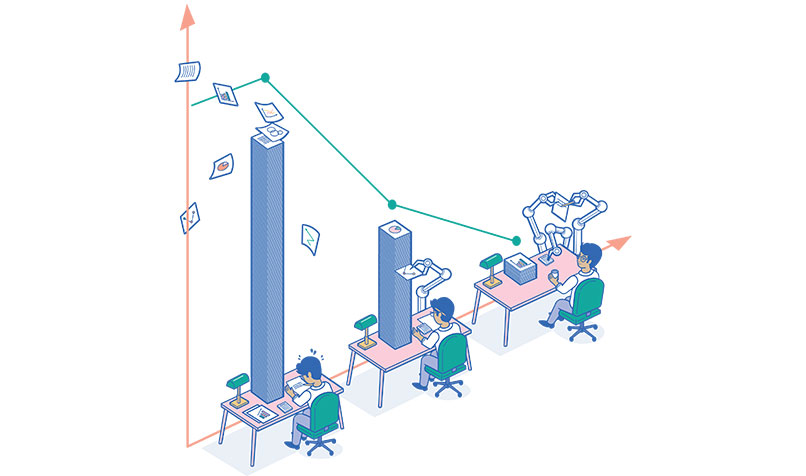

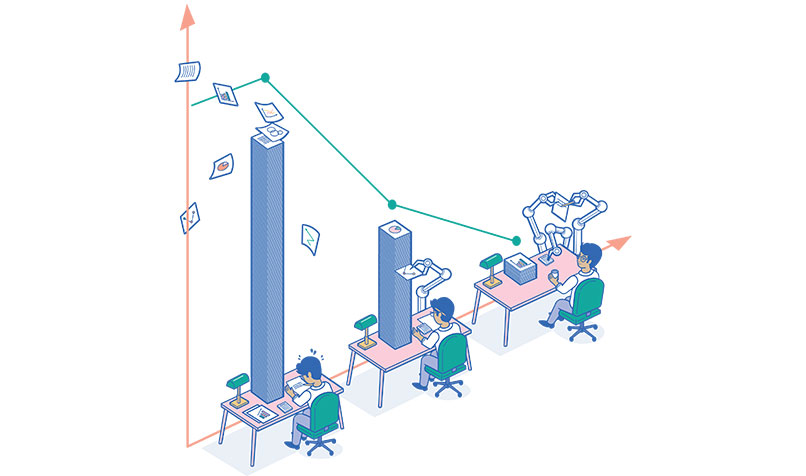

Technology’s getting even smarter. What does that mean for the accounting sector? A growing number of repetitive tasks are being delegated to robots, leaving accountants more time to look for value-added opportunities.

copyright by www.intheblack.com

When Oxford University and Deloitte explored the impact of artificial intelligence (AI) and robotics in 2015, the BBC used the data to build a nifty online calculator. Users can plug in their job title and find out how likely it is they will be impacted over the next couple of decades. That calculator reveals that accountants will be among the first professionals impacted; 95 per cent will likely face some threat from advanced technology. Meanwhile, the Committee for Economic Development of Australia (CEDA) has predicted that up to 40 per cent of the workforce, or more than five million jobs, could be automated by 2035.

When Oxford University and Deloitte explored the impact of artificial intelligence (AI) and robotics in 2015, the BBC used the data to build a nifty online calculator. Users can plug in their job title and find out how likely it is they will be impacted over the next couple of decades. That calculator reveals that accountants will be among the first professionals impacted; 95 per cent will likely face some threat from advanced technology. Meanwhile, the Committee for Economic Development of Australia (CEDA) has predicted that up to 40 per cent of the workforce, or more than five million jobs, could be automated by 2035.

Microsoft founder Bill Gates is so concerned about the impact robots might have on employment that he has suggested corporations pay a robot tax for roles that replace humans with robots.

Such a tax seems far-fetched, but robots coupled with AI or cognitive platforms are going to have a profound impact on accountants, auditors, the nature of work generally, and the broader economy.Blockchain and distributed ledger technologies are also set to disrupt these professions.What does it mean for the accounting sector? How many accountants will lose their jobs? Or should the shift be viewed as an opportunity to retrain and provide more value?

The future of robotics is now

Since the arrival of cloud computing platforms, a growing share of accounting’s donkey work has been automated. Software firms such as Xero, Intuit and Reckon have all made everyday accounting processes simpler and faster. Reconciliations and report generation are now being done using robotic process automation (RPA) solutions from the likes of BlackLine, Thomson Reuters and Wolters Kluwer. Technology’s getting even smarter. In February 2017, the US arm of H&R Block announced that it was working with IBM’s cognitive computing platform Watson to ensure its retail clients don’t miss out on any tax deductions or credits. Watson has been trained on the 74,000 pages of the US federal tax code and prompts an H&R Block accountant about deduction or claim opportunities as they complete a client’s tax return. […]

read more – copyright by www.intheblack.com

Technology’s getting even smarter. What does that mean for the accounting sector? A growing number of repetitive tasks are being delegated to robots, leaving accountants more time to look for value-added opportunities.

copyright by www.intheblack.com

Microsoft founder Bill Gates is so concerned about the impact robots might have on employment that he has suggested corporations pay a robot tax for roles that replace humans with robots.

Such a tax seems far-fetched, but robots coupled with AI or cognitive platforms are going to have a profound impact on accountants, auditors, the nature of work generally, and the broader economy.Blockchain and distributed ledger technologies are also set to disrupt these professions.What does it mean for the accounting sector? How many accountants will lose their jobs? Or should the shift be viewed as an opportunity to retrain and provide more value?

The future of robotics is now

Since the arrival of cloud computing platforms, a growing share of accounting’s donkey work has been automated. Software firms such as Xero, Intuit and Reckon have all made everyday accounting processes simpler and faster. Reconciliations and report generation are now being done using robotic process automation (RPA) solutions from the likes of BlackLine, Thomson Reuters and Wolters Kluwer. Technology’s getting even smarter. In February 2017, the US arm of H&R Block announced that it was working with IBM’s cognitive computing platform Watson to ensure its retail clients don’t miss out on any tax deductions or credits. Watson has been trained on the 74,000 pages of the US federal tax code and prompts an H&R Block accountant about deduction or claim opportunities as they complete a client’s tax return. […]

read more – copyright by www.intheblack.com

Share this: