To be a digital lender, banks and credit unions must do more than provide a digital app. Internal lending processes must be transformed to eliminate friction and unneeded steps, with artificial intelligence (AI) supporting proactive loan decisions.

copyright by thefinancialbrand.com

A great deal of discussion has surrounded the importance of building a seamless digital account opening process. As found in the Digital Banking Report, Digital Account Opening and Onboarding, progress is beginning to be made, as more organizations are allowing consumers to open new checking accounts online and on a mobile device. With the exception of a very few progressive banks and forward-thinking fintech firms, however, not nearly as much progress has been made in digital lending. To date, the focus of most digital investments in lending have been to improve the customer-facing digital output, with significantly less attention placed on digitizing the back office. While some of the resulting changes may improve the customer experience in the short-term, these mostly cosmetic changes are easily replicated, and don’t necessarily improve the overall customer experience.

A great deal of discussion has surrounded the importance of building a seamless digital account opening process. As found in the Digital Banking Report, Digital Account Opening and Onboarding, progress is beginning to be made, as more organizations are allowing consumers to open new checking accounts online and on a mobile device. With the exception of a very few progressive banks and forward-thinking fintech firms, however, not nearly as much progress has been made in digital lending. To date, the focus of most digital investments in lending have been to improve the customer-facing digital output, with significantly less attention placed on digitizing the back office. While some of the resulting changes may improve the customer experience in the short-term, these mostly cosmetic changes are easily replicated, and don’t necessarily improve the overall customer experience.

A simple application is too little

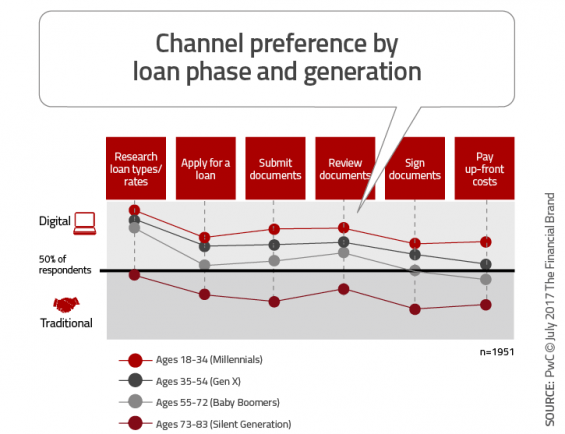

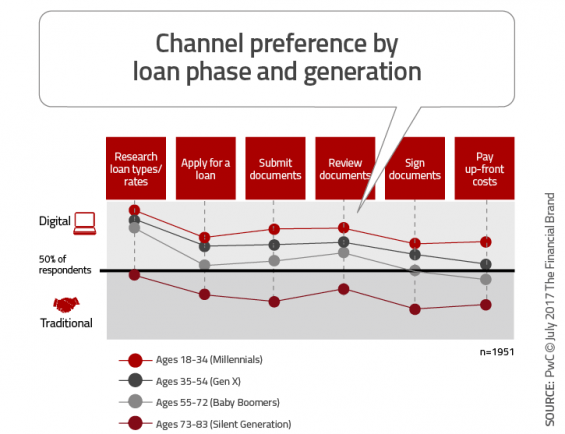

Having a digital application is not enough. According to PwC , a financial organization must initially define what is desired from both a customer experience and operational efficiency basis around consumer lending. Next, banks and credit unions must build a digital lending strategy around the following organizational competencies. The path to becoming a true digital lending organization involves five steps.

- User-Centric Design: Applying design thinking principles, oriented to both internal and external users. Tools that are used to support user-centric design include journey maps, borrower personas, ideations of multiple concepts, listening labs and prototypes.

- Data-Driven Decision Making: Making the right information available at the right time, to the right stakeholders, in the right format. Artificial intelligence (AI) and machine learning can match customer needs with the right product … proactively.

- Flexible Infrastructure: Systems and architectures must be configurable, aligning to real-time requirements that may extend beyond traditional ecosystems to accommodate external APIs.

- Effective Development Approach: Development capabilities must align with the need for a much more intense speed-to-market functionality. Delivering ‘high velocity’ IT and an agile framework that is iterative is no longer optional.

- Organizational Agility: Beyond systems and back office processes, there needs to be a tearing down of the silos that can stall development and implementation. This requires a change in culture that supports innovation and promotes change.

The expectations of the digital borrower have increased over the past several years, mostly based on marketplace offerings and digital experiences in other industries. While the interest rate and closing costs on loans are still primary considerations, the speed, simplicity, transparency and customer service of the entire process is important. […]

read more – copyright by thefinancialbrand.com

To be a digital lender, banks and credit unions must do more than provide a digital app. Internal lending processes must be transformed to eliminate friction and unneeded steps, with artificial intelligence (AI) supporting proactive loan decisions.

copyright by thefinancialbrand.com

A simple application is too little

Having a digital application is not enough. According to PwC , a financial organization must initially define what is desired from both a customer experience and operational efficiency basis around consumer lending. Next, banks and credit unions must build a digital lending strategy around the following organizational competencies. The path to becoming a true digital lending organization involves five steps.

The expectations of the digital borrower have increased over the past several years, mostly based on marketplace offerings and digital experiences in other industries. While the interest rate and closing costs on loans are still primary considerations, the speed, simplicity, transparency and customer service of the entire process is important. […]

read more – copyright by thefinancialbrand.com

Share this: